In his State of the Union speech on March 1st, the US President Biden has evaluated the Russian invasion of Ukraine as an attempt to “shake the very foundations of the free world.” And as the leader of this “free world”, Biden responded by attempting to exclude the Russian Federation from the whole international system. Sanctions, freezing of assets, closure of air spaces, travel bans and even exclusion from the Olympic Paralympic Games followed.

This attempt to exclude Russia especially from the global economy and global energy markets had a severe affect on the US: Until now an overseer of above all global energy supply and markets, the United States is now forced to organize the market directly.

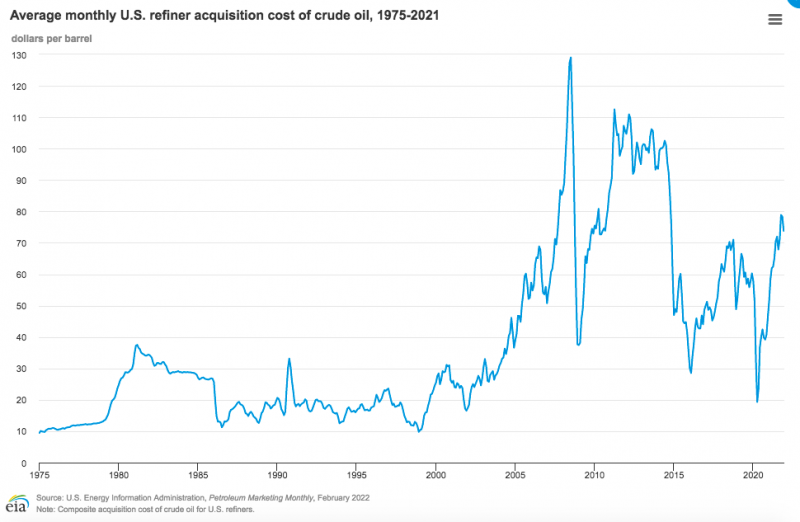

According to the US Energy Information Administration, Russia produced 11% of global oil in 2020. US sanctions currently attack Russia’s access to international financial institutions (though with energy-related exceptions), oil extraction equipment and the transport sector.

But now, the United States faces severe challenges in close relation to specifically energy politics:

1. To ensure global supply of oil

As mentioned above, Russia delivers 11% of global production. In addition, other leading countries such as Iran and Venezuela are under US sanctions, while some countries like Mexico prefer domestic consumption to export.

Asked about sanction on Russia’s oil sector, “but what’s really essential is that we maintain a steady supply of global energy. We don’t want to disrupt — look, — energy is a global market and we do not want to disrupt that market”, said Dr. Cecilia Rouse, Chair of the Council of Economic Advisers in the White House.

2. To secure the provision of oil at low prices for industry, households

Energy is part of nearly all other production and accumulation processes. Thus, its price affects all business calculations on profitability. Oil prices influence heavily the reproduction capability of households, especially in countries that are focused on individual automobile mobility, such as the United States.

Besides, energy imports constitute an important factor in balance of payments for several, above all emerging countries. Rising prices endanger oil importing countries’ participation in the global financial system.

3. To avoid general inflation as a consequence of oil price increase

With energy and oil being part of every accumulation, its price rise leads to rise of goods’ price and hence, inflation.

The US Federal Reserve Chairman Jerome Powell already stated to a US Senate hearing that “war could fuel inflation”.

The IMF Managing Director Kristalina Georgieva stated on March 5: “Should the conflict escalate, the economic damage would be all the more devastating. The sanctions on Russia will also have a substantial impact on the global economy and financial markets, with significant spillovers to other countries.”

The ‘Wall Street’ fears stagflation as in the 1970s, reports Reuters.

The US’ insistence on Ukraine’s NATO membership – the demand that Washington refuses to step back from – puts the whole global economy in jeopardy. Washington reacts with several steps on the supply-side:

Releasing oil from ‘strategic reserves’

Acknowledging “significant market and supply disruptions”, the United States announced the sale of 30 million barrel from the strategic reserves of the country on March 2.

In a meeting called upon by the US, members of the International Energy Agency also announced to put on sale 30 million barrels from their reserves.

But with the world consuming roughly 93 million barrels a day, the sale did not achieve any result in lowering the prices.

Contacting Saudi Arabia – getting rejected

The US administration has contacted Saudi Arabia’s representatives officially twice since the start of the Russian operation in Ukraine: on February 24th, Deputy Secretary of State Wendy Sherman spoke with the Deputy Foreign Minister, and on March 2, Secretary of State Antony J. Blinken spoke with the Foreign Minister of the Kingdom of Saudi Arabia.

Saudi Arabia’s Crown Prince Mohammed Bin Salman then provided an interview to the Atlantic, published on March 3.

“Where is the potential in the world today?” he said. “It’s in Saudi Arabia. And if you want to miss it, I believe other people in the East are going to be super happy.”

Asked whether Biden misunderstands something about him. “Simply, I do not care,” he replied. Alienating the Saudi monarchy, he suggested, would harm Biden’s position. “It’s up to him to think about the interests of America.” He gave a shrug. “Go for it.”, reports The Atlantic.

A day later, a keynote address by Saudi Arabia’s Oil Minister Abdulaziz bin Salman at a Houston energy conference was taken off the agenda, reported Reuters.

Contacting the United Arab Emirates – getting rejected

The United States also contacted the United Arab Emirates on February 24 when Secretary of State Antony J. Blinken spoke with the UAE Minister of Foreign Affairs and International Cooperation Sheikh Abdullah bin Zayed Al Nahyan.

But the UAE abstained from supporting a US resolution in the UN Security Council condemning Russia’s interference in Ukraine, later supported a similar one in the General Assembly. But still, on March 3, the UAE ambassador to Washington declared US-UAE relations were “being tested”.

Contacting OPEC – getting rejected

The United States made another effort by calling the OPEC to increase oil production. Such an increase would support US efforts to exclude Russia from global energy markets by substituting its production with others – a clear ‘geopolitical’ intervention.

But the OPEC bluntly rejected that. On March 2 after concluding its regular ministerial session, the organization stated “current volatility is not caused by changes in market fundamentals but by current geopolitical developments”.

This was a slap in the face, as the OPEC members announced that these sanctions-caused developments, in other words, the US foreign policy, was not reason enough to change production.

Hence, they stuck to their previous decision to increase production by 400 thousand barrels a day.

Knocking at the door of Venezuela

In a last effort, the United States has sent a delegation to the Bolivarian Republic of Venezuela. What the New York Times announces as part of “isolating Putin” is actually another and pretty desperate move to access “to potential alternate source of oil supplies” as some analysts told Reuters.

The likelihood that Venezuela would support sanctions against Russia by selling oil to the US seems very low though.

US divided on further sanctions

In the meantime, a new bipartisan bill has been introduced to the Congress widening the sanctions against Russian oil exports.

But: “We don’t have a strategic interest in reducing global supply of energy … that would raise prices at the gas pump for Americans,” spokesperson Karine Jean-Pierre said at a White House news briefing.

But given the steadily rising prices in gas and oil, US allies are warning. The German Minister for Economy, Habeck said that sanctions on Russian energy exports would endanger “social peace in Germany”.

Meanwhile, US Secretary of State Blinken is on a trip to Europe. Speaking to CNN from Moldova, Blinken said “We are now talking to our European partners and allies to look in a coordinated way at the prospect of banning the import of Russian oil while making sure that there is still an appropriate supply of oil on world markets. That’s a very active discussion as we speak.”

Oil price as a measure for US claim of unipolar world

Indeed, one might say that the US claim of a unipolar world can be measured in exact numbers these days: the price of oil in the global market. And according to that, it is not going well for Washington.

Leave a Reply