By Mohamed Sabreen, Cairo / Egypt

The BRICS summit will be held from October 22-24 in the Russian city of Kazan, and the summit is starting amid high hopes and difficult challenges. After the addition of new countries, most notably Egypt, interest in the new bloc has increased. The BRICS leaders held a summit in South Africa last August, during which it was decided to invite four countries from the Middle East and North Africa region, namely Egypt, Iran, Saudi Arabia and the UAE, to join the group’s membership as of January 1, 2024. The BRICS countries seek to reduce the world’s economies’ dependence on the dominant dollar, and to establish the foundations of a multipolar international financial system in which the countries of the South play a greater role, which would inaugurate a new era of cooperation on the economic and geopolitical levels. The fact is that the accession of countries from the Middle East and North Africa to the BRICS group raises several pivotal questions, including: Why did these countries seek to join the group? And what unique characteristics can these countries offer to the BRICS group? What are the economic and geopolitical results that might be achieved from expanding BRICS membership in the long term? Despite these questions and doubts about the group, it is moving forward strongly.

The winds of optimism come from the long queue of countries wishing to join. On the other hand, some raise several other concerns about the ability of the new group to meet the aspirations of the countries waiting at the door of entry, and about the ability to provide a real alternative to the system dominated by the United States and the US dollar. The biggest challenges relate to the extent of Washington’s move in trying to thwart the new group led by China and Russia, and the other matter is whether this group will withstand the differences in visions between China and India, and whether the presence of countries such as Egypt, Ethiopia, Iran, Saudi Arabia and the Emirates will be a factor of strength or a “Trojan horse”. Most likely, the state of optimism is stronger so far than the fears.

Egypt is preparing with great hopes after its official accession, and previously, 22 countries, including Algeria, submitted official applications to join “BRICS”. While the Turkish authorities have applied to join the BRICS group, Bloomberg reported, citing informed sources, that Türkiye seeks to strengthen its influence in the world and expand its relations with developing countries. While Algeria wants to raise relations with the group’s countries to a new level and strengthen its relations with its main partners, including Russia. Bloomberg explained that the issue of expanding the group may be considered during the Kazan summit in Russia. Delegations from 126 countries are expected to participate in the forum. The event will also bring together representatives from 89 regions in Russia. More than 5,000 participants from 500 cities around the world will discuss current issues related to the economy, digital technologies, the environment, civil infrastructure, transportation, healthcare, education and culture.

From ordeal to grant

I think that the BRICS story calls for contemplation, and how a crisis can be transformed into an opportunity. It is known that the BRICS group, which was initially called BRIC, was conceived by Jim O’Neill, chief economist at Goldman Sachs in 2001. The name came from the first letters in Latin of the names of Brazil, Russia, India and China.

The idea was based on the possibility of building an economic alliance between these emerging economies, and trying to present a different framework for cooperation between the countries of the “South”, which was often singled out for a skeptical view of its ability to grow and achieve progress away from the dominance of the Western “Northern” system.

Many doubts surrounded O’Neill’s “theory” and tried to demolish the idea, based on the fact that the four countries have great diversity that prevents them from lining up under one banner. This matter prompted some to say that BRIC is nothing but a marketing ploy by Goldman Sachs, but the idea took a different turn in the midst of the global financial crisis.

While the four countries were studying the establishment of their group in 2006, the global financial crisis was escalating. With the launch of the first BRIC summits in 2009, the global crisis reached its peak, and its repercussions were imposed on everyone, but the four countries saw the crisis as an additional incentive for cooperation.

The first meeting of the BRIC countries was held in 2009, at a summit hosted by the Russian city of Yekaterinburg, and later South Africa was included in the group in 2010, to acquire its current name, i.e…. “BRICS”.

What is noteworthy is that the infection of criticism later spread to the owner of the theory himself. Two years ago, Jim O’Neill published an article in which he attacked the slow progress of the BRICS”, noting that “other than the establishment of the BRICS Bank, the group has not achieved anything other than the annual meeting”.

However, the “ordeal” of global crises always turns into a “gift” for the “BRICS” countries. International interest in the group has doubled, with the escalation of post-pandemic crises and the war in Ukraine. Instead of criticizing the slow pace of BRICS and China’s high growth rates, India has nearly doubled its GDP per capita. Since 2015, its foreign direct investment index has begun to converge with Brazil’s, and then surpassed Brazil’s, more than doubling in 2020 alone, placing India in second place in the group. More importantly, BRICS has been viewed beyond economic frameworks, and the “group” has become a path for political, security, and strategic coordination in a world that is rapidly moving towards facing storms of all kinds and directions.

What does Egypt benefit from?

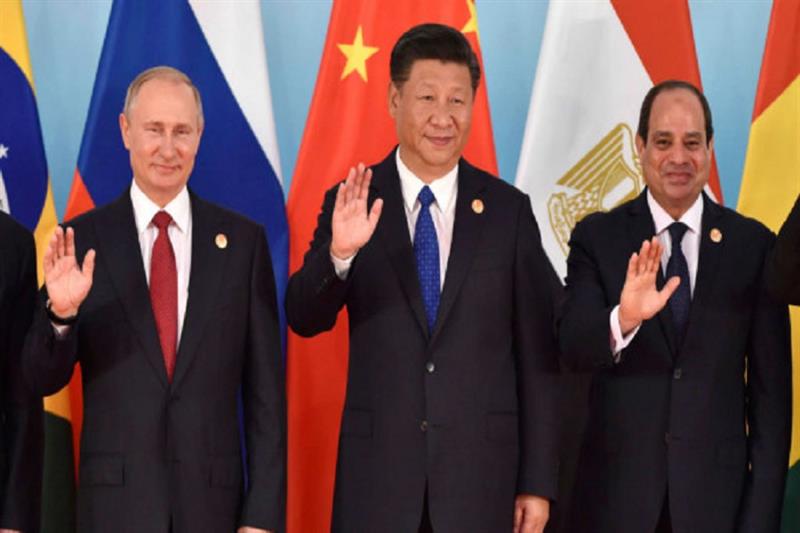

Returning to Egypt, Cairo found in the new group an opportunity and an important card to help it in light of the economic challenges it faces. The announcement of its accession to BRICS was a point of light that Egyptians welcomed and were very optimistic about. Egyptian President Abdel Fattah El-Sisi said in a statement that Egypt looks forward to working to “raise the voice of the countries of the South regarding the various development issues and challenges we face, in a way that supports the rights and interests of developing countries.”

El-Sisi added: “I appreciate the BRICS group’s announcement inviting Egypt to join its membership as of January 2024. We are proud of the confidence of all the group’s countries with which we have close relations, and we look forward to cooperating and coordinating with them during the coming period.”

Over the past few years, Egypt has suffered from an economic crisis that was exacerbated by the Coronavirus pandemic and the Russian invasion of Ukraine.

The Egyptian pound lost nearly half its value within 18 months, and annual inflation rose to a record level of 36.5% in July. The many loans over the past eight years have also increased the burden of repaying external debts. The Cabinet said in a statement immediately after Egypt’s membership was accepted that the bloc’s goal of reducing inter-dealing transactions in US dollars would ease pressure on foreign exchange in Egypt. In addition, Egypt’s presence as a member state of the BRICS Development Bank would provide opportunities to obtain soft financing for its development projects.”

The Egyptian Ministry of Supply said last April that it was discussing with China, India and Russia the use of their currencies in purchasing primary commodities.

On Thursday, the Information and Decision Support Center affiliated with the Egyptian Cabinet issued an analysis that highlighted the BRICS summit and the potential benefits for Egypt from membership in the group.

The Information Center said that Egypt’s joining BRICS is an affirmation of the strength of the good economic and political relations between Egypt and the bloc’s countries, and of its economic and geopolitical position in the Middle East and North Africa region.

It added that rapprochement with the BRICS group helps in “promoting the reforms that the Egyptian economic and investment environment has witnessed in recent years, in a way that increases Egypt’s chances of attracting more foreign investments.”

The center said that “the bloc’s goal of reducing Inter-dealing in US dollars will ease the pressure on foreign exchange in Egypt, the largest share of which is in the dollar, which is in favor of improving a number of local economic indicators.

It added that “Egypt’s presence as a member state of the BRICS Development Bank will provide opportunities to obtain soft financing for its development projects, in addition to its presence within the bloc meaning that it will benefit from the fruits of the success of its goals that are close to being achieved, with regard to creating a global system that gives more weight to developing and emerging countries.”

Egypt, a major importer of basic commodities, is suffering from a foreign currency crisis after the Ukrainian war caused major problems for its economy.

The pound has fallen by about 50 percent since March 2022 after the Ukrainian crisis revealed weaknesses in the Egyptian economy.

In December, the International Monetary Fund approved a loan to Egypt under the “Extended Fund Facility” worth $3 billion to be disbursed over 46 months.

Monica Malik of Abu Dhabi Commercial Bank said BRICS membership could ultimately help Egypt attract more investment.

“It is a positive for Egypt to join. While the impact is likely to be limited in the short term, it could help strengthen its ties with key emerging market economies,” she added.

Charles Robertson of FIM Partners said access to low-cost financing from the New Development Bank would help Egypt and that it made sense to approach China, a potential source of large foreign direct investment in Egyptian industry.

“Egypt has two pressing needs, access to foreign direct investment and cheaper debt, and BRICS membership could help achieve both,” Robertson added.

“Whether it is the injection of Saudi and Emirati capital, or Egypt benefiting from that capital, this bank is a welcome addition to the global financial architecture,” Robertson added.

James Swanston of Capital Economics said BRICS expansion was unlikely to have major economic impacts in the near term, but “the potential shift in geopolitical conditions could have long-term implications for trade and economic growth.”

Another viewpoint on BRICS

While most experts agree on the importance of BRICS, Egyptian economic expert Magda Shaheen, in a recent article in Al-Shorouk newspaper, called for moving away from daydreams and being cautious in our expectations regarding the BRICS group, considering it a group that will achieve a new global economic system. Shaheen stresses that the active movement of the BRICS group, known as emerging economies, and the increasing interest in this group on the part of developing and developed countries, especially the United States. This may be an indication that this group has become strong enough to impose itself on the international scene to the point of provoking the United States, as it sees it as a potential threat to its sovereignty as a single superpower.

Shaheen believes that the formation of the BRICS group reflects once again the well-known tradition of heads of state who have always wanted to prove the independence and freedom of their countries. While the leaders of Egypt, India, Indonesia, Ghana and Yugoslavia (Nasser, Nehru, Sukarno, Nkrumah and Tito) met in the aftermath of the Korean War to balance the dual polarization of the world during the Cold War and established the Non-Aligned Movement, the BRICS countries came to assert their independent economic model, challenging the capitalist model and aiming to give emerging economies a voice in the post-World War II institutions dominated by the United States and its allies. Interestingly, the idea of the BRICS group was born during the 2008 G8 summit in St. Petersburg, Russia, when Russia was still part of the closed club of advanced countries before its expulsion, and India and China were invited on the sidelines of the summit as leading economies. The presidents of Russia, India and China met and agreed to create a special group of emerging economies and held the first summit the following year, inviting Brazil to join. No one denies that Egypt has been eager to join this group since its inception. It competed with Nigeria and South Africa to join, and the choice fell on South Africa with a pledge to expand in the future. The new group was launched bearing the first letter of the name of each of the five countries (BRICS).

The BRICS group remained almost closed in on itself during the past years, a period in which China was considering itself an economic power on the international level. The main concern of the countries of this group was to prove their ability to grow and develop according to an independent model other than that imposed by Western countries or the Soviet Union at the time. A model that combines the two and maintains the primary role of the state while at the same time encouraging the private sector to invest and grow. This is what we have seen develop successfully in China, Brazil and India.

Shaheen adds that despite the economic power that the BRICS group has gained, it has continued to be marginalized in the context of global governance. Its call for reform has fallen on deaf ears and the call of its presidents to rotate the executive directors of multilateral financial institutions, especially the International Monetary Fund and the World Bank, has been ignored. When their hopes of bringing about the desired change were dashed, the BRICS countries decided to establish their own New Development Bank to once again reflect their independence and ability to finance development operations in themselves and other developing countries according to their principles, far from conditionality and the development model promoted by financing institutions at the behest of the United States and its allies. The purpose of this bank is to balance the international economic system and give developing countries a sense of independence in their own development path without being obligated to adopt methods imposed on them from outside. The bank was established in July 2014 and is headquartered in Shanghai, with each of the five countries contributing an equal share of the subscribed capital of $50 billion, each with an equal vote, and open to membership for both developed and developing countries. However, it did not receive much attention when it was established and countries did not rush to join it, as it seems that the projects were limited to the BRICS countries, contrary to promises to establish development projects in developing countries as a whole. Only Bangladesh and the United Arab Emirates have joined the organization so far in 2021, and Egypt recently joined in February 2023.

Although Egypt is well positioned to mobilize resources for infrastructure and development projects, as a member of a number of international development banks (the World Bank, the European Bank for Reconstruction and Development (EBRD), the African Bank, the Islamic Development Bank and the Arab Bank for Economic Development in Africa), Egypt has the right to knock on all doors to obtain the financing it needs for its development, especially if it is on concessional terms. While it is too early to judge the advantages of joining another development bank, it is assumed that Egypt has carefully studied the pros and cons of its membership, ensuring that the benefits of its membership are proportionate to its financial contribution.

It is important to note that joining the New Development Bank does not mean that we are dealing with a government development agency, which provides highly concessional official development assistance funds with a maturity of fifty years and an interest rate of less than 1%, known as ODA. Rather, we are dealing with a bank that borrows from the market, like other development banks, to preserve its capital and its ability to expand, and whose borrowing costs are usually lower than those of commercial banks, which allows these banks to offer slightly better than market rates.

However, the New Development Bank does not enjoy the same privileges to borrow from capital markets, as its membership is still very limited, unlike other development banks that have a larger number of guarantors from the rich and industrialized countries in the world. It can be speculated that Egypt’s accession may implicitly facilitate trade in national currencies. The Russian Central Bank has added the Egyptian pound to its list of exchange rates against the ruble. China and India are also moving towards signing trade agreements with Egypt in local currencies. This in itself may be a major advantage for Egypt at a time when it is in dire need of its hard currency. Shaheen confirms that the BRICS group has not aimed since its inception to change the existing international economic system or clash with any of the economic powers, but rather wanted to introduce some reforms in order to balance the economic powers that changed after World War II and to obtain a voice heard in international financial institutions, proving its independence and freedom of thought away from the cloak of the United States and its allies.

Question marks

This group is certainly keen on its relations with the West, as Western powers still represent the open market for BRICS products and export advanced technology to them.

However, the new trends of the BRICS group in expanding and strengthening the use of national currencies and threatening the Gulf countries to exchange oil away from the dollar, indicating a desire to reduce the oil-for-dollar agreement, angered the United States, which did not hesitate to launch a violent attack on the group, declaring that it would not allow – even by force – to tamper with the dollar or harm its economy, and the United States considered the trend to deal with local currencies a direct hostile action against it.

In this regard, there are several questions that are difficult to predict the correct answers to now, for example:

1- Will the United States allow the BRICS group to disappear on its own, just as the Non-Aligned Movement disappeared when it lost its reason for existence? Or will it continue to launch its attacks on this emerging group until it is killed in its cradle?

2- How deep is the conflict between China and India and the extent of its internal impact on the group’s survival?

3- To what extent can Russia, in light of its declining international and regional power, impose its use of the ruble?

And other questions that make us inquire about the strength and continuity of the BRICS group and its ability to change the international economic system.

The Western view

On the other hand, reading the transformations in the Western view of BRICS highlights the extent of the influence that the group has come to enjoy. In 2011, two years after the first BRICS summit, Martin Wolf, a columnist for the Financial Times, saw that the group’s countries are “not a group” and “have nothing in common at all”, based on the fact that there are many differences between the founding members of the group. He considered China and Russia to be “totalitarian” countries, while Brazil, India and South Africa are “democratic” countries. Unlike the rest of the BRICS members, Brazil and South Africa do not possess nuclear weapons, in addition to the existence of a severe border conflict between China and India, where fighting erupts repeatedly between the two Asian giants.

In contrast, this view has changed with the expansion of the BRICS countries’ influence, in light of current international crises, and the growing attractiveness of the group to many countries around the world. This is what researchers Thorsten Benner and Oliver Stuenkel (from the International Public Policy Institute in Berlin) acknowledge in an analysis published early last August, as they believe that the “attractiveness” that BRICS now enjoys to many countries around the world “should attract the attention of Western countries and push them to make changes in their approach to dealing with the international arena.” The researchers point out that this attractiveness represents “a lack of confidence in the current international system,” and that “Germany and Europe must put forward serious reform proposals, including the continent’s refusal to automatically appoint the head of the International Monetary Fund, and instead work towards better representation for Africa, Latin America, and Asia in the Security Council and United Nations institutions, and even make good and fair proposals in trade policies.”

Why BRICS is rising

The reasons for BRICS’ rise in global interest are not limited to its growing attractiveness alone, or the strength of the economies of some of its members, most notably China, the world’s second largest economic power, which is expected to become the largest in the next few decades. It represents a huge market, especially for raw materials, and an indispensable factory for all countries in the world, including the United States. This is because the matter lies in many of the reasons for the strength that BRICS countries have been able to develop, most notably providing an alternative. The alternative here is not limited to the idea of the group’s countries proposing to build a “multipolar world” as a theoretical slogan, but rather by turning the slogan into reality.

Here, for example, cooperation between BRICS countries has succeeded in withstanding global crises, especially the pandemic and the Russian war in Ukraine. Since the beginning of the crisis, BRICS countries have distanced themselves, as India, Brazil, South Africa, or China have not participated in imposing sanctions on Moscow, and this has been increasingly confirmed by the near-historical levels of trade between India and Russia, or Brazil’s reliance on Russian fertilizers.

The BRICS countries have also provided alternatives to Western-led economic and political forums and institutions, such as the G7, the World Bank and the International Monetary Fund. Today, the BRICS countries’ contribution to the global economy amounts to 31.5 percent of the global economy, exceeding that of the seven major industrialized countries. It is expected to rise to more than 37 percent with the inclusion of the six countries invited at the Johannesburg summit.

The BRICS countries also recently launched the New Development Bank (NDB) with an initial capital of $50 billion in 2014 as an alternative to the World Bank and the International Monetary Fund. The bank (based in Shanghai, China) has provided more than $30 billion in loans for development projects on terms that are more favorable than those provided by international institutions dominated by Western powers, to give members of the group more control over development finance.

The matter did not stop there, but the countries of the group established an emergency reserve fund, the aim of which is to support member countries struggling to pay off debts in order to avoid flood pressures, and also to finance infrastructure and climate projects in developing countries. On the other hand, the countries of the group established the “BRICS Payment System”, which is a payment system for transactions between the “BRICS” countries without the need to convert the local currency into dollars. These countries are now seriously considering expanding trade exchange between them in local currencies, or issuing a unified currency for interoperability, which many observers consider a long-term alternative proposal, although it will not affect the dominance of the US dollar in the near future, which currently represents 60 percent of foreign exchange reserves in central banks worldwide. This gradual building of power tools by the BRICS countries is seen by Dr. Nivedita Kundu, an international relations expert and a fellow at the Indian Council of World Affairs think tank affiliated with the Indian Ministry of External Affairs, as an “effective means” for the bloc countries to increasingly impose themselves on the global political scene, especially in areas such as international negotiations, peacekeeping, and conflict resolution efforts, especially after the accession of countries such as Saudi Arabia, the UAE, and Egypt, which play prominent roles in the crises of the Middle East region, and have weight in several international files.

However, Kundu stresses the importance of realizing that the BRICS countries currently “do not aim to replace the West, but rather seek to achieve greater representation and influence in global affairs, and call for building a more equitable and inclusive global economic and political system.” She points out that BRICS has benefited from its collective strengths, which have been strengthened by the addition of the six new countries, and have increased the size of the bloc’s contribution to the global economy and its possession of greater spread and diversity in markets and tools of influence, which contributes to increasing BRICS’ ability to drive the transition to a more sustainable and just global economy.

Kundu noted that BRICS countries’ investments in emerging technologies such as artificial intelligence and renewable energy could make them major drivers of global economic growth and innovation in the near future. The Indian expert added that by 2030, BRICS countries, after the Johannesburg “expansion” or in other future phases, are expected to contribute more than 50 percent of global GDP. If these countries reach an agreement to conduct trade using a common currency, this could accelerate the process of eliminating the dollar, which would further consolidate their importance on the international stage.

Desire to get rid of hegemony

Most likely, the most important thing that unites these countries is the desire to get rid of the hegemony of the United States and the dollar, and they are not seeking to confront, and are not in a hurry, and acquiring 50 percent of the global gross domestic product seems to be a future ambition for the BRICS countries, knowing that these countries have almost this number, but from the population of the Earth and the land area on it. The group includes 5 of the largest and most densely populated countries in the world, and it has grown with the expansion of membership, to become a “tool for changing geopolitics,” according to the vision of Dr. Amira Shawky Suleiman, Vice Dean for Graduate Studies and Research at the Faculty of African Graduate Studies at Cairo University.

Suleiman says that with the accession of the six new countries, most of which are countries with promising economic capabilities, and the possibility of more members joining in the future (about 20 countries have submitted official requests, most of them from the global South), “this will greatly affect global geopolitics and geoeconomics, and it can be said that BRICS may redraw the map of the world.”

The Egyptian academy adds that the bloc countries are “currently witnessing their geopolitical awakening,” and that over the past ten years, the group has achieved fruitful results in political security, economics, trade, finance, cultural exchanges, global governance, and other areas of cooperation. It has become a model for cooperation between the countries of the Global South, and has attracted more developing countries wishing to join BRICS day after day. She goes on to say that with the accession of Saudi Arabia, the UAE, Egypt, and Iran, which are oil and gas producing countries, in addition to their future investments in the field of green energy, the group now owns more than half of the global share of oil and natural gas, which enhances the group’s position in the energy market, and thus doubles its global influence.

A postponed confrontation

On the other hand, the idea of conflict with the West does not seem – at least so far – to be among BRICS’ priorities, and perhaps this is one of the group’s tools of strength, as the BRICS countries do not adopt the doctrine of “whoever is not with us is against us” that has been reflected in American policy for decades. The bloc’s countries do not expect all its members to choose fixed alliances, or to change their ties with Western countries. China, the most powerful founder of the bloc, has close and growing trade relations with the United States and Europe, far exceeding the volume of its trade with the BRICS countries themselves. India and Brazil also have strong relations with Western countries. Therefore, the expansion of the bloc’s membership, as reflected in the decisions of the Johannesburg Summit, according to many observers, including Paul Kariuki, a South African political researcher, “does not depend on the idea of hegemony and polarization.” Kariuki explained that this “flexibility in granting BRICS members, following the expansion, the freedom to build alliances… could be an attractive element for many countries, especially African countries, two of which have joined (Egypt and Ethiopia) and have strong relations with the United States and Europe… as most countries on the continent want to strengthen their partnership with BRICS without this costing them entering into conflicts with the West.” Most likely, this bloc was created to remain and provide realistic alternatives for the countries of the Global South.

Leave a Reply