Liz Truss has been Prime Minister only for two months, already causing a lot of discontent from the British public. The main reason for the stir is Liz Truss’ “growth-oriented mini-budget”. Truss has sacked Chancellor Kwasi Kwarteng, but there are still dissenting voices within the Conservative Part. The Labour Party is rising in polls, while leading public figures and the media are decrying Truss’s “U-turn” and the damage her mini-budget has done to the economy.

What Truss’ budget proposal means

Here are the prominent and controversial items in Liz Truss’s budget:

- Income tax was reduced from 20 percent to 19 percent for the income group from £ 12,571 to £ 50,270 per year.

- The tax on the highest income group above £150,000 was reduced from 45 percent to 40 percent.

- The corporate tax increase announced by the previous government from 19 percent to 25 percent for 2023 was cancelled.

Truss aims to boost investment and growth by reducing taxes, especially for the high-income group and rich and big companies. As she said: ”I have three priorities for our economy; Growth, growth and growth.” The new government defends the new budget as a solution to the stagnation.

Michael Roberts explains the background of this economic policy as follows: “This is a reversion to a very old idea in neoclassical economics: trickle-down economics. The term ‘trickle-down’ originated as a joke by humorist Will Rogers. Rogers used the term to criticize economic policies that favored the wealthy or privileged while being framed as good for the average citizen.

Backing with the data, Roberts concludes his analysis: “These tax cuts did not produce faster growth than in the golden age period of 1948-64 when these tax rates were high; and ironically, the tax burden as a % of GDP did not fall either because GDP did not rise enough to surpass increased revenues from other taxes.”

Headlines criticize “U-turn”

Aside from the debate about whether this economic policy increases inequality, almost everyone agrees on this: Truss’s mini-budget led to a sharp fall in sterling and, at least in the short term, has caused market panic, the damage from which will take time to recover.

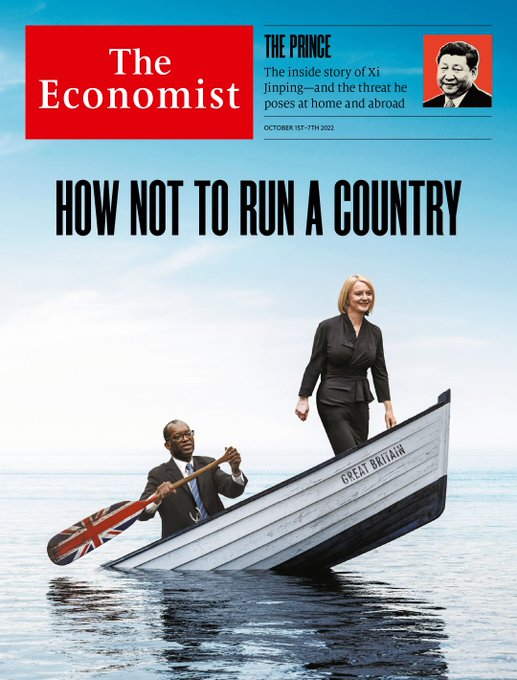

The Economist cover photo of October 1-7 depicted Liz Truss and Kwasi Kwarteng on a sinking boat: “HOW NOT TO RUN A COUNTRY”

On October 4, the headline of Daily Mirror was: “Damage is done: Chancellor laughs off his top tax U-turn, but budget chaos will still cost billions”.

On the same day, the Financial Times ran the headline “Kwarteng quickens debt cut plan after U-turn”.

On October 13 the headline of Daily Mirror was presenting two options to Liz Truss: “U-TURN OR YOU GO”.

Andrew Rawnsley in his article titled “Johnson was slow-poisoning arsenic for the Conservatives, Liz Truss is instant cyanide” in The Guardian on 9 October, writes ”One month into this PM’s reign and already the chatter is about how to remove her. … Never in the field of British politics has a leader become so staggeringly unpopular in such a spectacularly short time.”

Lastly US President Joe Biden stated that Liz Truss’ plan was a mistake and he is not the only leader critical of abandoned plan.

Handicaps of Liz Truss

After Boris Johnson, when the Conservative Party held a ballot to appoint the next Prime Minister, Liz Truss was third in the first round of voting, behind Rishi Sunak (88 votes) and Penny Mordaunt (67 votes). In the second round of the ballot, Liz Truss became prime minister with 81,326 votes against Rishi Sunak’s 60,399.

Many are now pointing out that the Conservatives, especially in the first round, did clearly not favor Liz Truss. The result of the first round can be also interpreted such as 305 Tory MPs not thinking that Liz Truss is the best candidate for prime ministry. Perhaps more importantly, unlike the previous Prime Minister Johnson, Liz Truss was not elected by the people, but appointed by some 200,000 Conservatives.

In his article above-mentioned article Andrew Rawnsley claims that Liz Truss has “two potential sources of salvation: One is to be popular. Most Tory MPs never much trusted Ms. Truss’s predecessor, but they indulged him for a very long time because they thought he knew how to harvest votes; and the second is to form a government that embraces representatives of other factions.”

Rawnsley’s second option also points to the fierce opposition to Liz Truss within the Conservative Party. This is no secret and is often regarded as one of Liz Truss’s main handicaps, along with the fact that the people did not elect her.

Before Liz Truss

Liz Truss’s budget was most criticized for causing panic in the markets and devaluing the pound. The value of sterling to the dollar fell in October to a level not seen since 1985. At that time, the pound had fallen to $1.042. But whatever the impact of Liz Truss’s policy, the British economy is already in difficulty for two reasons: one structural and the other actual political circumstances.

In the article “Europe’s descent into deindustrialisation”, published on 30 September on Spectator, Philip Pilkington traces back to the roots of current economic difficulties. As the title of the article implies, the difficulty that Europe and the UK are facing is not totally new, and one of the reasons is the process of deindustrialization that Europe has been going through for several decades.

Pilkington puts it this way: “The only logical European response to the threat of widespread de-industrialisation is to raise tariffs. This is the only way to equalize prices between more expensive European goods and cheaper foreign goods, therefore artificially supporting European manufacturing. This strategy will lower living standards, depriving Europeans of cheaper goods, but it will at least preserve some manufacturing jobs.”

Added to this is the problem of skyrocketing energy prices. According to Pilkington, the UK is no exception and the bells are ringing for other countries as well: “The rapid economic collapse that Britain is facing is simply an accelerated version of what the whole of Europe is about to go through; unsustainable borrowing to fund the gap between high energy prices and what households can actually afford.”

Indeed, this point also leads us to one of the things that linksa the UK and Europe – the indebtedness across Europe. In 2019, Eurozone government debt-to-GDP was 83.8 per cent. In 2020, after Corona virus period it hit 97.2 per cent. In the same period, Britain’s figures are 83.8 per cent and 93.9 per cent respectively.

Companies benefit from increasing energy prices, while no solution in sight for the population

Many people in Europe and around the world are wondering how Europe will cope with the huge increase in energy prices added to structural factors. Benefiting from the sanctions against Russia, huge companies in the energy sector in some countries, such as the US, continue to increase their profits, while for the vast majority of the population there is no permanent solution in sight.

Pilkington likens the current economic situation to the Great Depression. But he adds that there is “one key difference this time around: “There is a rival economic bloc that could be insulated from these dynamics, the emerging BRICS+: Brazil, Russia, India, China, South Africa and Argentina – with Iran, Türkiye, Egypt, Indonesia, and Saudi Arabia also joining the queue.”

Leave a Reply