The German Chamber of Industry and Commerce (Die Deutsche Industrie- und Handelskammer – DIHK) published the results of surveys conducted with companies between June 10 and 30, 2024.

The report, titled “Energy Transition Barometer 2024” (Energiewende-Barometer 2024), is based on interviews with 3,283 companies and provides striking insights into the challenges faced by German businesses.

Not satisfied with the energy transition

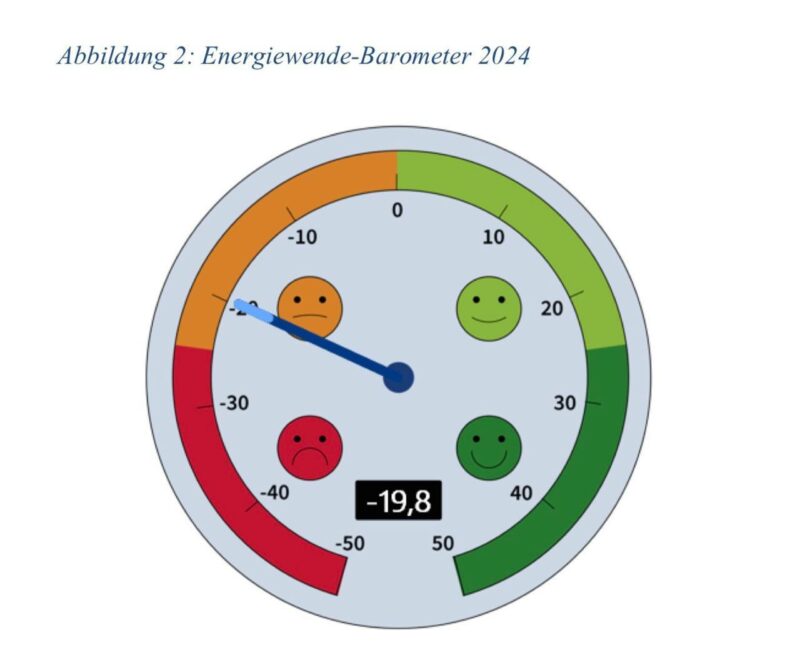

Like many other European countries, Germany is pursuing an economic transition aimed at “protecting the environment and combating global warming”. The report posed the question, “How do you assess the impact of the energy transition on your company’s competitiveness?” to companies regarding this process, named as “Energiewende” in Germany.

On a scale from minus 100 (“very negative”) to plus 100 (“very positive”), the average satisfaction score among the 3,283 companies from all sectors, regions and sizes is a negative 19.8. (All graphs below are taken from the report, UWI.)

Turning point: the war in Ukraine

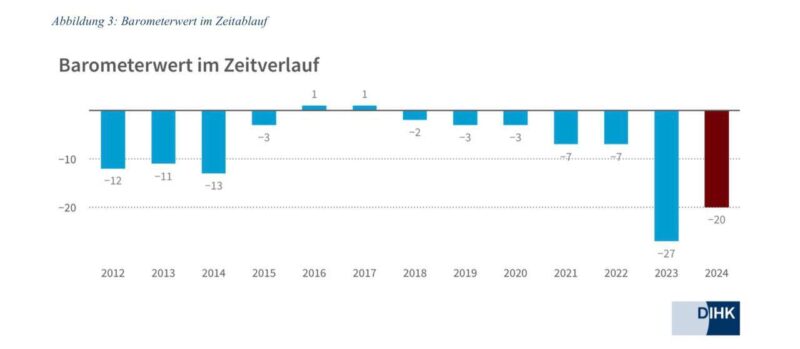

Comparisons over the years reveal a worsening trend. The years 2023 and 2024 represent the most negative assessments of the energy transition on the same scale of minus 100 to plus 100.

The report evaluates this situation with the following statement:

“For many years, the barometer value was moderately negative or slightly positive. Before 2023, it had never been worse than minus 13. The companies’ attitude towards energy policy reached a turning point in 2023. The war in Ukraine and the energy price crisis fundamentally changed something.”

The industry sector sounds the alarm

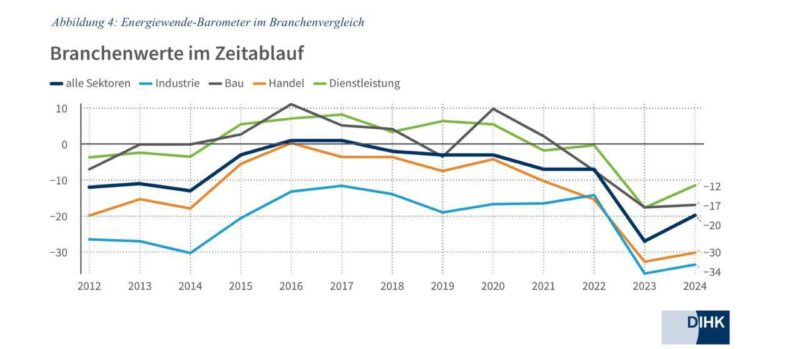

The report also provides an evaluation by sector:

“The sectoral comparison clearly shows the breaking point in 2022/2023 with the energy crisis and the war in Ukraine. All sectors’ barometer values are clearly in negative figures.”

While the service sector showed a slight increase but still remained in negative figures, “Industrial companies, which are much more affected by energy prices, remain at an alarmingly negative level of minus 34”.

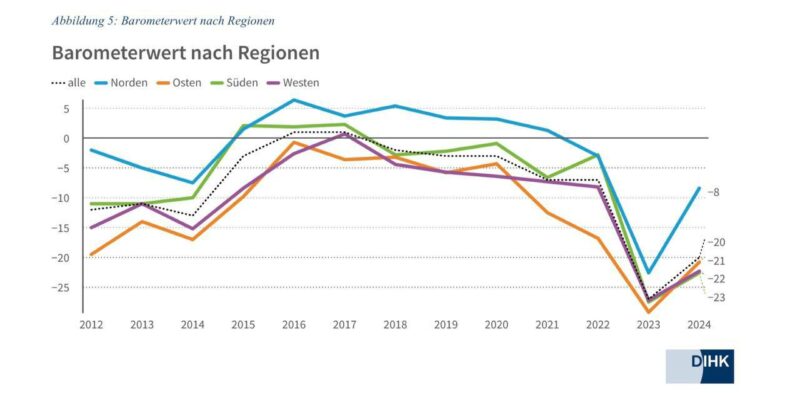

The north is better than others

In the regional analysis, the report observes that the north has significantly more positive assessments compared to other regions. The report attributes this to “better utilization of the opportunities offered by the energy transition”.

The report notes that “plans to reduce production in Germany are intensifying across all sectors”. A manager of an industrial company in Western Germany says the following: “The deindustrialization of Germany has begun, and it feels like no one is doing anything about it”.

Offshoring in rise

The report concludes: “Overall, this year’s survey shows a strengthening trend of going out of Germany as a business location”.

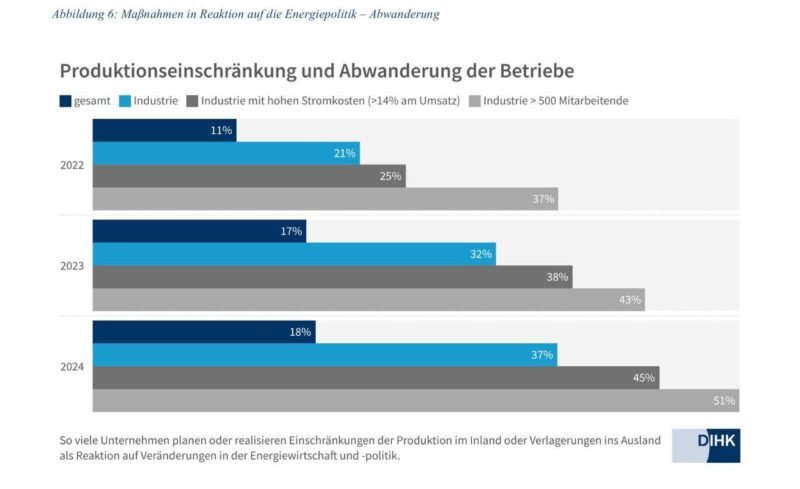

As seen in the table below, the trend of relocating the factories outside Germany has intensified in 2023 and 2024. This trend is particularly strong in the industrial sector, especially among companies with high electricity costs and those employing more than 500 workers.

Leave a Reply