While Russia’s military operation in Ukraine continued, the sanctions imposed on Russia by Western countries, especially the US, created controversy. As the Western media questioned whether the sanctions were effective or not, the big business emphasized the damage that the consequences of the sanctions would cause to Europe.

The USA and the European Union (EU) first took the decision to impose economic sanctions on Russia in 2014. According to the data of the global sanctions monitoring database Castellum.ai, the number of sanctions imposed on Russia with the Ukraine crisis has reached 9,655. Russia surpassed Iran (3,616 sanctions), Syria (2,608 sanctions), and the Democratic People’s Republic of Korea (DPRK) (2,077 sanctions) with these numbers. Venezuela with 651 sanctions, Myanmar with 510 sanctions and Cuba with 208 sanctions are also included in the list, which consists of 7 countries with the most sanctioned in the world.

The US, which has decided to impose sanctions on Turkey for purchasing the S-400s from Russia before, sees the sanctions as the most influential weapon in its hands to maintain its dollar dominance. However, not only the legitimacy of this ‘weapon’, but also how effective it is debated among the allies. So much so that the EU, which followed the USA in sanctions against Russia, found itself in a major energy crisis. In Europe, where the price of gasoline and diesel exceeds 2 euros, the increase in the energy prices is also reflected in production costs. The price of the basic food has risen accordingly. In many European countries, from Germany to Italy, Spain, France and Greece, people are protesting the cost of living and the energy crisis. Different EU countries would be affected to different degrees by sanctions.

Food and energy crisis

According to Andrew Milligan, Edinburgh-based market strategy veteran and former U.K. Treasury official, the sanctions on Russia create myriad downsides for the global economy. While the sanctions are putting great pressure on food prices, the decrease in exports of food and critical agricultural products is a cause for concern. Ukraine and Russia are both known as global breadbaskets of the World. Because of the sanctions, since the beginning of February the traders increased the price of grain by about 77%. Milligan also said that due to rising energy costs and technology firms pulling out of Russia, the growth from GDP will decrease in the U.S. and Europe’ economies.

“The truth is, Europe has no substitute for Russian gas,” said Ronald Smith, senior oil and gas analyst at BCS Global Markets.

Russian President Vladimir Putin, on the other hand, did not succumb to the sanctions and decided to accept payments only in rubles for Russian gas sold to “unfriendly” countries. Putin’s determination caused alarm, especially in France and Germany. Markus Steilemann, Chief Executive Officer of the chemical giant Covestro, warned about the devastating consequences of the gas embargo in his speech on April 21: “It could lead to the collapse of entire production and supply chains. It would put hundreds of thousands of jobs at risk.” Martin Brudermüller, Chairman of the Board of Executive Directors of BASF group, one of Germany’s largest electricity consumers and the world’s largest chemical company also warned that an embargo on Russian gas could plunge the German economy into the “most severe crisis since the end of World War Two.”

Patrick Pouyanné, CEO of French energy giant TotalEnergies, said that his group cannot do without Russian gas. “I’ll be very clear: if I decide to stop importing Russian gas, I don’t know how to replace it” Pouyanné told French radio RTL.

Russia accounts for around 40% of the European Union’s imports of natural gas, a key source of energy for the bloc. It also supplies a quarter of the bloc’s oil imports.

Putin’s decision threatens dollar hegemony

While Putin’s decision to pay in rubles reinforced the “trade in local currency” goals of non-Western countries, it was perceived by the Atlantic as a threat to the US dollar-based system. Gita Gopinath, first deputy managing director of the International Monetary Fund, told the Financial Times that the unprecedented financial sanctions imposed on Russia threaten to gradually dilute the dominance of the US dollar and result in a more fragmented international monetary system. She warned that the sanctions could encourage the emergence of small currency blocs based on trade between separate groups of countries.

Daisuke Karakama, Chief Economist of the Japanese Mizuho Bank, emphasized in an article for JB Press that separating Russia from the international banking system SWIFT would weaken the role of the dollar in world finance. “The possibility of connecting Russia to the Chinese international interbank payment system CIPS in connection with the blocking of SWIFT, where dollars are mainly used, was discussed from the very beginning of the sanctions. If this returns to normal, the hegemony of the dollar will crack”, he said.

On the other hand, Europe, which has set itself the goal of determining policies independent of the United States, but flock after Washington for sanctions against Russia, is facing the consequences of this situation. Europe’s giant companies are warning that the sanctions will have heavy costs for Europe. Many European companies are hesitant to stop trade with Russia.

European giants are worried

On April 12th, Guillaume Faury, Chief Executive of the Airbus, urged European leaders not to block imports of titanium from Russia, saying sanctions on the strategic metal would damage aerospace while barely hurting Russia’s economy. “Sanctions on Russian titanium would hardly harm Russia, because they only account for a small part of export revenues there. But they would massively damage the entire aerospace industry across Europe,” a company spokesperson said.

Deutsche Bank boss Christian Sewing is also among those who have warned against the negative effects of sanctions against Russia. Questioning the stricter sanctions proposals against Russia, Sewing said, “These sanctions have a negative effect on us as well.” Also criticizing the proposal to close the Nord Stream line, Sewing said, “If we turn off Nord Stream, this will not mean the end of Russia’s gas supply to Germany, but it will soon lead to major energy supply problems and significantly higher prices in our country.”

Another warning about the sanctions came from Stefan Hartung, Chairman of the Board of Management of German giant Bosch, at the beginning of the month. “Abandoning Russian gas would lead to a complete shutdown of production at Bosch plants,” Hartung told Handelsblatt.

Germany’s BDI industry association also warned that rising energy and gas prices “threaten to crush the economy,” adding that “the situation is so serious that even medium-sized companies from various sectors that are loyal to their location are having to consider relocating abroad.”

Western sanctions against Russia hit the production at plants from companies including Volkswagen and Stellantis. The imposed sanctions have exacerbated lingering component shortages and halted production at Volkswagen and Volvo Trucks. VW’ Kaluga factory that employs 4,200 people, suspended operations. Thousands of auto workers have been furloughed. Valery Uglov, an auto mechanic at the VW’ Kaluga plant asked that if it make sense to impose sanctions on its own plant and lose money.

Mike Fulwood, senior research fellow at the Oxford Institute for Energy Studies talked about the potential damage of the sanctions on Europe, “It is also unlikely…the EU would target energy as refusing to buy oil, gas and coal from Russia would do huge damage to the EU economies — more so in the short term than to Russia.”

Warren Patterson, head of commodities strategy at ING, said Western sanctions imposed on Russian banks or industries were likely to have “a far-reaching impact on the commodities complex” that could spread across markets in which the country is a leading exporter, including aluminium, nickel, copper and platinum.

British finance minister Rishi Sunak is one of the names who warned that sanctions on Russia would add to their economic problems. “What I would say to people is they should feel confident about the strength of our economy,” he told Sky News. “But the outlook is uncertain … because of what’s happening in Ukraine.”

Western media is questioning the effectiveness of the sanctions

While the executives of the big business are warning about the impacts of the sanctions on production, the Western press is questioning whether the sanctions are effective.

In an article by Ross Clark, published in the British magazine The Spectator, on the impact of sanctions on Russian and Western economies, it is said that the West overestimates its own economic power, while emphasizing that the main factor driving Russia’s economy is energy. The article states that the current situation shows how difficult it is for the West to isolate and collapse the economy of its rival. Reminding that two major energy markets such as China and India did not participate in the sanctions, it is stated that on the contrary, the two countries benefited from the discounts. The article highlights the urgency of the question of whether sanctions will work: “Economic sanctions, while initially seemed to hurt Russia, are working much less obviously now.”

In another article, published in British publication the Financial Times, with the title “How could sanctions against Russia hit European economies?”, it is stated that the consequences of the sanctions may adversely affect the energy, trade, manufacturing, banking and markets of Europe. It is also emphasized that Europe’s vulnerability to sanctions against the Kremlin goes far beyond energy. The writers warned that heightened tensions could lead to “increased costs throughout the whole structure of prices” in the eurozone economy. The article ends with this sentence: “Peace is a lot better than any kind of war from an economic point of view”.

The title of the article published by Will A. Smith in the National Interest, the publication of the Washington-based think tank Center for the National Interest, is as follows: “Maximum Pressure Sanctions Won’t Work Against Russia”. In the article, it is stated that the sanctions policy imposed by the US to many countries caused great pain in national economies, but failed to reach its main strategic goal. Examples of this failure are cited as such; the nuclear agreement with Iran, the unification of the army around Maduro in Venezuela, the “continuation of repressive policies” by the Taliban in Afghanistan, the developing nuclear activities in North Korea despite the sanctions, and Bashar Assad’s government which continues in its eleventh year in Syria. Therefore, it is emphasized that there is no reason to believe that the heaviness of the sanctions will force Putin to withdraw. The author states that the use of sanctions to punish Russia is not an adequate strategy to stop the war. It is said that the war will eventually end with negotiation, but if Moscow does not believe that sanctions will be eased, it will not agree to such a negotiation. On the contrary, it is emphasized that if the sanctions continue, Putin will not want to leave Ukraine without a victory and will escalate the situation. The author therefore advises the Biden administration to be clear that sanctions will be lifted if a deal is secured, warning not to take away Ukraine’s chance to negotiate.

The Washington Post also noted: European sanctions on Russia will cost Europe, too, early signs show. Expressing that the European business world is concerned about the sanctions due to their own economies, the Washington Post article states that the sanctions have begun to damage Europe with an economic cost that affects energy prices, inflation and raw material costs.

Again in the US-based The Wall Street Journal, Europe’s challenge is summarised with the following headline: “Rocketing Prices Test Europe’s Political Resolve in Confrontation With Russia”. The article states that rising food and fuel prices have fueled discontent in Europe by testing the political resilience of Western democracies. From France to Spain, Germany and Greece, nearly stagnant wages and rising prices are said to have fuelled protests and put pressure on governments that have become fragile post-Covid-19 pandemic. The article questions how tolerable this situation is: “The darkening mood raises questions about how much European voters are willing to tolerate the economic costs of what looks likely to become a protracted confrontation with Russia.”

Judy Dempsey from Carnegie Europe asks the experts if the sanctions could be effective and she gets the following answer: “While these raise the cost of war for Moscow, on their own they are unlikely to change Putin’s calculations.” One of the experts Dempsey asked, Krzysztof Bledowski, Council Director and senior economist at the Manufacturers Alliance for Productivity and Innovation, points to China as an important global power that can have an impact on the Kremlin. Stating that countries oppressed by the sanctions of the West, such as Iran, DPRK and Venezuela, trust Russia or China, Bledowski says that Beijing’s side with Moscow on sanctions will reduce the impact of the sanctions.

European people’s support for sanctions decreased

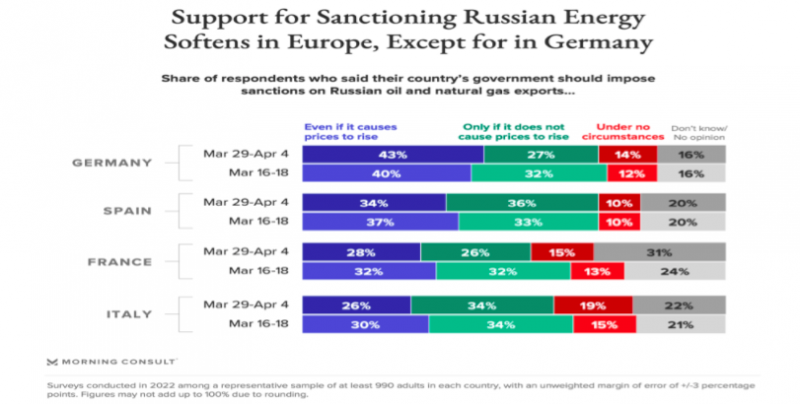

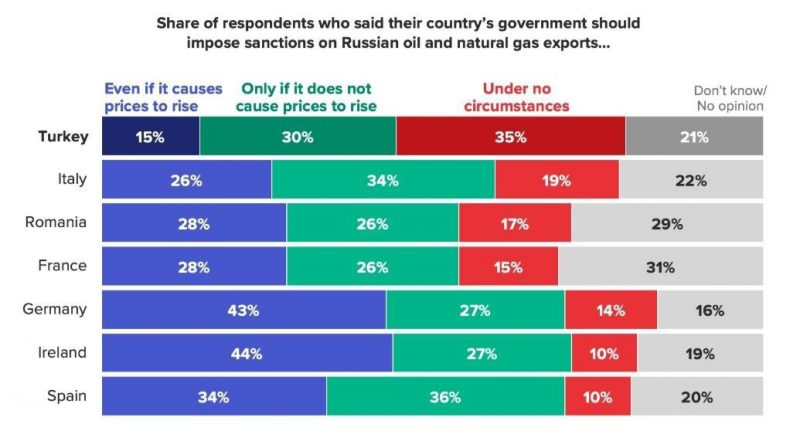

The doubts about the sanctions against Russia are not limited to companies and the media, the European public also shares this confusion. According to the survey of the Global decision intelligence company Morning Consult, support for energy sanctions among Europeans is declining, with the exception of Germany. Morning Consult’s analysis includes the following comment after the survey: “About a quarter of Germans and the French, as well as around a third of Spaniards and Italians, approve of energy sanctions only if they would not cause price increases. But that’s effectively impossible given economic realities… Then again, whatever boost Europe’s reaction to the invasion provided seems to be wearing off.” https://morningconsult.com/2022/04/07/european-support-for-oil-gas-sanctions-russia-ukraine/

It is obvious that the most successful area of sanctions is to prolong the Ukraine crisis. While Washington, which wants the war to continue and takes advantage of it, defends the sanctions to the end, it is not clear how long its European allies can continue this policy, which puts themselves in trouble. The powers that want this issue to result in successful negotiations will sooner or later give up the weapon of sanction.

Leave a Reply