The global capitalist economy seems in disarray. From increasing inflation to vulnerable supply chains, from endangered food production to energy transition and crisis – complaints and warning calls rise at nearly every chapter and branch of the world economy.

United World International thus has started a new series of articles and interviews that will shed light on the situation of the global economy from the perspective of different national economies.

Above all stands the question, whether the world is heading towards a new global great depression, as witnessed in 1929.

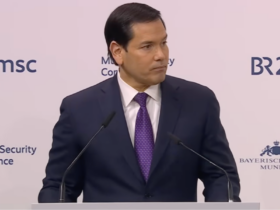

On the situation of Türkiye’s economy, we spoke to Recep Erçin, journalist specialized on economy.

How do you currently evaluate your country’s economy?

Türkiye’s economy is continuing its growth thanks to its very dynamic and diversified production structure and the supply it provides to major export markets, also supported by the value loss of the Turkish currency the Lira. Especially the productive sector shows food numbers. On the other side, high inflation and an import dependency of 90% in energy leads to increasing production costs and disturbs pricing policy. The domestic demand for foreign currencies is continuing, and despite the foreign currency income from exports and tourism, this creates problems for the balance of payments of compositions.

Therefore, the government pursues what I call “an exchange regime with close man marking in limited space”. That means, the government tries to overcome this foreign currency shortage by applying smooth capital controls. It is true that this is an unsustainable situation. As long as the global energy prices continue to be on the level they are, Türkiye’s economy will continuously be threatened over the current balance.

No economic crisis “in classical sense” in Türkiye

Do you observe signs of an economic crisis in your country? If so, based on which indicators?

We cannot say that there is a crisis in Türkiye in the classical sense of the expression. Because in order to speak of a classical economic crisis, we need to to find decrease in GDP, a decrease in domestic demand, connected with that a decrease on the supply side, problems in the delivery of certain products and services, accompanied by problems for economic actors to access financing for needed purchase of goods and services. We do not see any of these criteria for an economic crisis in Türkiye.

What we do see in Türkiye is the slow but steady development of an economic bottleneck. What is this bottleneck? The export-focused growth strategy leads to relative poverty domestically. A policy of competitive exchange rate is pursued, which in turn leads to decrease in the people’s purchasing power, to an increase of inflation over increasing import prices. In addition, companies that are working to the domestic market are losing profits, while credit packages that support production keep at the same time so-called “zombie companies” alive. At the end, we end up with a production structure that is inefficient and has a domestically low added value.

It is true that this production structure supports growth due to an increase in foreign demand, which in turn results from the breaking of global supply chains. But this process does not lead to the creation of richness and welfare in the country but to the transfer of national resources to the exterior at low prices.

Wages’ share in national income decreased by 7 percent in the last years

In this model, the so-called drop theory of capitalism does not work. The gap between the working classes and the capitalists is widening more and more. We can observe this ugly picture very well in the seasonal data on GDP. The share of wages in the national income has decreased in the last years by 7 percentage points.

In summary, we can state that today, there is not a crisis in the classical sense in Türkiye. But the situation is changing continuously to the disadvantage of the wage earners and low-income sectors. We expect the economic model to evolve according to the stance these will take, and it is just a matter of time that this turns into a classical crisis.

Regarding the causes of the economic crisis: Which are the domestic and which are international factors that you consider as important? How do you see the relation between these?

As I mentioned in the response to the last question: If we are going to speak of an economic crisis, this is a crisis of the wage earning and low-income sectors. We can summarize the factors as such: As it is relying on a certain sector, the government has preferred to enrich the capitalist class. In terms of foreign balances, geopolitical positioning impedes Türkiye’s access to much needed sources of foreign currency. While the growth model of depending on foreign capital is abandoned, the costs of are laid on the back of the working classes.

How do you see the future of the global economy?

Regarding the global situation, I do expect the eruption of a classical crisis. It would be too optimistic to expect that the speculative balloons, which have developed since a long time during the low inflation, low interest rates and expansive monetary policies, to silently disappear while these policies are abandoned.

In addition to that, the world is living a huge energy crisis, accompanied by a food crisis, while in a geopolitical sense bipolar globalization has long started. I expect all these changes to lead to economic ruptures as well.

What is your solution for the above-mentioned crisis?

Crises belong to the nature of capitalism. A crisis will erupt, and afterwards, the system will probably evolve to a new order. In terms of a solution I can say the following: A decreasing of the central capitalist countries’ currencies weight over the global financial system will prevent crises from proliferation. The use of national currencies in trade between countries and a change in the international financial architecture, which currently is Atlantic-centered, will also keep externalities of central capitalist countries from flowing to the developing market economies.

Leave a Reply