By Serhat Latifoğlu

In late 2024, China’s 30-year bond yield fell below Japan’s 30-year bond yield for the first time in history. This drop, which brought 30-year bond yields below 2%, was the result of China’s slower than expected growth and the Chinese Central Bank’s measures to revive the economy. Western media was quick to exaggerate and distort this. Comparing the China’s situation to Japan’s deflationary and stagnation period they name it as “Japanification”. In Türkiye, neoliberals were also quick to take part in this campaign. Prof. Dr. Özgür Demirtaş from Türkiye declared that the Chinese economy is “in shambles”. Before, he had declared that Russia would collapse within three months following its special military operation.

But is the Chinese economy really in trouble? Let’s examine the arguments of neoliberals.

Their “dissatisfaction” with China’s 5% growth borders on the absurd. The US and G7 countries, which they admire, barely managed to grow by 1% in 2024, whereas China achieved 5% growth during a year when the world was teetering on the brink of recession (according to IMF estimates).

When we look at the growth trends over the past decade in the table below, it becomes evident that the Chinese economy has grown steadily. To speak of stagnation like Japan’s, we need to observe consecutive years of growth below 2%. The table shows both the strength of China’s economic growth and superiority over the Western bloc, the US and G7.

“The middle-income trap”

Neoliberal economists claim that China has fallen into the “middle-income trap” by observing a decline in its growth rates in recent years compared to previous years. The middle-income trap refers to a situation where an economy, after reaching a certain per capita income level, stagnates and is unable to progress further. Economies in the middle-income trap typically face issues such as low savings rates, lack of investment, slow progress in industrialization and weakness in the labor market. Rising wages cause a loss of competitive advantage. However, this is not the case for China. In China, wages have continued to rise while the country has become a leader in several high-value-added high-tech sectors (such as electric vehicles and renewable energy).

One of the fundamental features of the Chinese economy is that it’s based on central planning. Through planning, priority sectors are identified, and massive infrastructure investments are made to ensure the continuity and sustainability of production. While these investments may initially appear as inefficient resource allocations that burden the budget and may even require borrowing, they begin to pay off after years, or even decades, depending on the area and tools of the investment. These investments are characterized by neoliberals as “inefficient, public burden and inflationary”. When China started its rapid high-speed rail investments largely funded through borrowing, the Western media ridiculed it. Today, China is the country that has the fastest mobilization of its traveling and working population through high-speed rail. Here the savings and added value generated are extremely high. Also, the Chinese Railways company, which Western media predicted would fail, is now significantly increasing its profits and rapidly paying off its debts.

Another claim by mainstreams economists is that China has a so-called “excessive capacity”, is “overproducing” and “subsidizing in a way that distorts competition”. However, for instance, American company Apple produces far more cell phones than the US market demands, in other words, it produces at high capacity and exports worldwide, which is nothing other than “excessive capacity” in neoliberal definitions. Or what about the “excessive capacity” reached by the US’s oil industry in recent years? Shale oil production is breaking records annually and being exported all around the world. The large-scale production in the US has played a significant role in lowering global oil prices. The oil and technology sectors in the US are among the most subsidized and supported industries. Yet, neoliberals tend to overlook or downplay the support and incentives given to these industries in the West.

China’s venture capital outpaces the West

China’s venture capital ecosystem has already outpaced the West. The reason for China’s significant advancements in new technologies is that the Chinese government supports the best private ventures at every stage regardless of their political orientations. Neoliberal economists, who claim China is overproducing, overlook China’s contribution to the solar energy sector getting cheaper thanks to China’s production, innovation and initiatives.

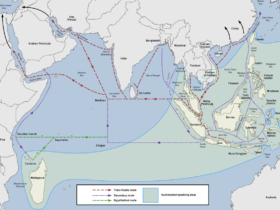

Three key factors behind China being a trade partner to 120 countries are: an abundance of rare metal resources, proficiency in green technology and vast industrial production capacity. So, contrary to neoliberals’ claim, it is impossible to isolate China. China is the only country in the world that produces at least one part of almost every intermediate good. While the US aims to reduce its dependency on China by sourcing intermediate goods from India, Mexico and Vietnam, these countries import intermediate goods from China, change their origin and then export them to the US. Despite all of the US’s efforts, China is far from losing market share.

Pressuring China works?

The statements made by Jim Farley, CEO of Ford, one of the largest American automotive companies, after his visit to China were striking. Farley admitted that China is producing much cheaper and higher-quality products than Western automotive brands and that the presence of Western companies is openly threatened by China. Ford suffered a $5 billion loss in 2024 from its investments in electric vehicle production. Ford is now seeking to keep its production afloat by acquiring patents from China and forming partnerships with Chinese companies. A similar thing applies to Apple and other major American companies. Apple’s reliance on Chinese intermediate goods increases every year which offers a clue as to why Trump’s policy of pressuring China would fail. Another important aspect is that even if the US were to end its dependency on China, China’s domestic market is large enough to compensate for the loss of the US market.

Leave a Reply