In previous articles we have said that imperial power is based on three pillars: its great military apparatus, its undoubted superiority in terms of control of the global cultural-media apparatus and the self-granted power of being the holder and sole issuer of the dollar – a currency that plays the role of the main exchange instrument for world trade.

In future articles we will elaborate on the first two of these criteria, whose situation is different and have particularities, because while the military predominance begins to fade, the preponderance in the field of culture and communications has become the primary tool for sustaining their hegemony.

Today we will give some clues to expose the progress of the de-dollarization process that seems to be the most moving and the most accelerated progress in terms of weakening the global power of the United States.

The figures are clear: in 2001, world reserves in dollars were 73% of the total, by 2021 that figure had been reduced to 55% and to 47% the following year. This exposes that last year the share of the dollar in world finance fell 10 times faster than the average of the last two decades, which is undoubtedly a figure of extraordinary impact. According to the Brazilian international analyst Pepe Escobar: “Now it is no longer unreasonable to project a world share of the dollar of only 30% by the end of 2024, coinciding with the next US presidential elections.”

Paradoxically, the origin of this abrupt drop came from the freezing of Russian reserves in the West (an amount greater than 300 billion dollars), sounding the alarm that it was no longer safe to hold dollar reserves abroad. From that moment on, a veritable avalanche of de-dollarization was unleashed that has been evidenced through decisions of countries and international alliances throughout the planet.

Although the process has followed a gradual development, the moment in which it reached a level of profound acceleration could be in the month of April. Perhaps, if we wanted to establish for history a fact that expresses the moment of influence of this course, we could locate it at that moment when the president of Brazil Lula da Silva reflected aloud on the matter during his trip to China last April: “Every night I wonder why all countries have to trade backed by the dollar […] Why can’t we trade backed by our own currencies? Who decided that the dollar was the (global) currency after the disappearance of the gold standard? Why not the Yuan or the Real or the Peso?”

A few days earlier, on March 30, Brazil and China had announced a trade agreement that would allow them to use the currencies of the two countries, the yuan and the real, respectively. This decision, although it was not the first, was inserted in a dynamic that would ensue, stimulating other Latin American countries and other regions to follow this path.

Thus, Argentina, in a situation of deep economic and financial crisis motivated by a lack of foreign currency that was aggravated by the impositions of the International Monetary Fund (IMF) and a difficult negotiation of the payment of the debt, decided to renounce the dollar as payment of this debt, resorting to the Chinese Yuan not only in regards of the trade with Beijing, but also to pay its own debt to the IMF.

In the same month of April, similar processes began to be decided upon in other places on the planet. Thailand and China began talksto further promote their national currencies for bilateral trade, which they have used for years for transactions between the two countries. In addition, the People’s Bank of China has established cooperation mechanisms with the Ministry of Finance of Japan, the Central Bank of Malaysia and the Bank of Indonesia to use national currencies for trade, investment and payments in the private sector.

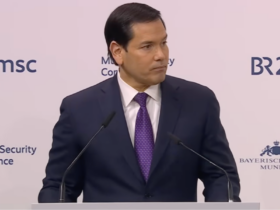

Similarly, other countries have joined the de-dollarization such as Russia, Saudi Arabia, Belarus, Iran, and Egypt, which are promoting the use of national currencies for bilateral trade, all of which has set off alarm bells in Washington, which is watching undaunted as one of the pillars of sustenance of its global domination crumbles. In this sense, Republican Senator Marco Rubio said: “If this trend continues, in 5 years the White House will not be able to sanction any country.” Likewise, acknowledging that though if it’s difficult to stop using the Dollar, Janet Yellen, Secretary of the United States Treasury, affirmed that if this happened, it would have very serious consequences for her country. In an act of strange compliance, Yellen conceded “the sanctions against Russia have pushed nations to stop using the American currency.”

Given continuity to what at the end of April already seemed an inevitable course of events, the president of Syria, Bashar al-Asad, urged to abandon trade in dollars, proposing to replace the US currency with the Chinese Yuan. According to the Syrian president, “… the war between the West, led by the United States, and sovereign countries is mainly economic, [so] it is necessary to get rid of the shackles of trading with the US dollar.”

Similarly, on April 22, Bangladesh and India agreed to conduct a portion of their bilateral trade transactions in their respective national currencies, the taka and the rupee. According to Afzal Karim, CEO of Sonali Bank Limited, the largest state-owned commercial bank in Bangladesh, the decision was based on the conviction that “the bilateral trade with India in taka and rupees will take pressure off the US dollar, producing a benefit for both countries.”

Within this framework, the foreign ministers of the BRICS group, meeting in Cape Town on June 1, addressed the issue, discussing the possible launch of a common currency to advance the de-dollarization process and its possible expansion, ahead of the summit. of heads of state and government of the economic bloc to be held next August. In this regard, the Minister of International Relations and Cooperation of South Africa, Naledi Pandor, stated that this was a matter that should be discussed and “properly discussed.”

Considering that some of the countries involved up to now in the process are members of the BRICS group, to which more than 20 countries have requested their incorporation, the five countries that make up this association produce 32.1% of the World GDP compared to 29.9% of the Group of Seven, the impact of what is happening is of global strategic importance.

Following the trend, Indonesia, one of the largest economies in Southeast Asia, joined the BRICS group’s decision to move away from the dollar and trade with its own currency, initiating the diversification of the use of the currency in the form of LCT [trade in local currency]. According to the governor of the Bank of Indonesia, Perry Warjiyo, the direction is the same as that of the BRICS, but in fact, Indonesia has taken more concrete decisions, since Jakarta had already implemented local currency trading with several countries such as Thailand, Malaysia, China, and Japan and South Korea.

It is worth mentioning that in this framework, as an expression of Chinese interest in internationalizing its currency, in March, the Yuan became the most used financial instrument for carrying out cross-border transactions in China, surpassing the dollar for the first time with an increase of 26% from the previous month according to a Reuters calculation based on data from China’s State Administration of Foreign Exchange.

Already in the month of May, following this guideline of international finance, the Zimbabwean government set out to launch a gold-backed digital currency to reduce its dependence on the dollar. and protect its citizens from currency fluctuations. According to the Reserve Bank of Zimbabwe, (RBZ) in a first phase, gold-backed digital currencies will be issued for investment purposes with a vesting period of 180 days and redeemable in the same way as the currencies existing gold physics.

In South America, following the Brazilian-Argentine bilateral decision to trade with their local currencies, Bolivia announced that it was examining the possibility of not trading in US dollars and using China’s Yuan to carry out its international transactions. In a press conference on the 10th of that month, the Bolivian president Luis Arce affirmed that Argentina and Brazil, being the two largest economies in the region, were already trading in Yuan in agreements with China, and explained that despite the fact that the area has traditionally been under the influence of the United States, currently many countries They have more foreign trade with China than with the North American country, adding that the region’s trend is going to be that. Based on this diagnosis, Arce declared that: “Bolivia could not remain outside of what is happening while it does direct trade with China, [so] it is not necessary to trade in dollars.

Along the same lines, the president of Venezuela, Nicolás Maduro, said that his country must adhere to a system in which “currency is not used to enslave the peoples” for which he considered that Venezuela must “be inserted in the initiative de-dollarization of the world”. At the same time that he ordered his cabinet to study other alternatives for commercial exchange in order to avoid the political use that the United States makes of its currency, the Bolivarian president explained that “while the world is more multipolar, multicentric and balanced, a [larger] basket of currencies for trade and financial operations”

TO BE CONTINUED…

Cover graphic by Rob Bogaerts

Leave a Reply