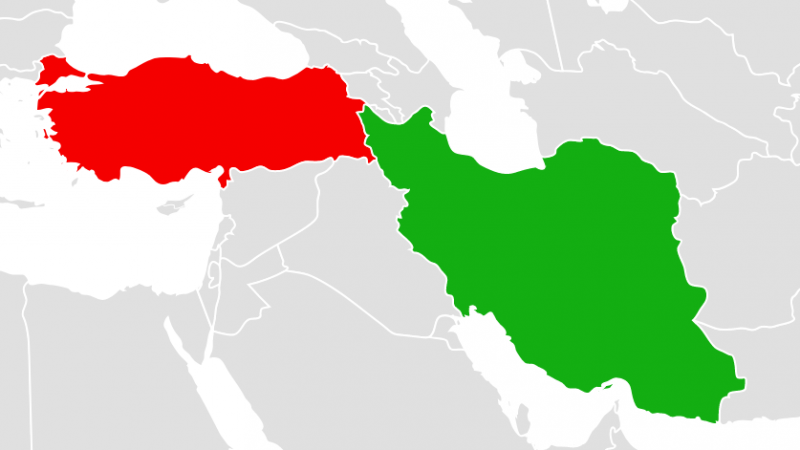

With the onset of EU/US sanctions on Iran’s energy sector, the country’s oil and gas production capacity decreased dramatically. Following the signing of the 2015 Iran nuclear deal, formally known as the Joint Comprehensive Plan of Action (JCPOA), however, is was hoped that the country would be provided with an opportunity to attract more foreign investment, not least that which would allow it to recover its oil and gas production capacity. With growing domestic energy demands, Turkey is in dire need of energy supplies from reliable resources. Turkey’s growing energy demand and dependence on foreign resources are the main reasons for fostering close relations with Iran.

Turkey aims to achieve a balanced diplomatic approach by signing gas agreements with Iran and Azerbaijan in order to lessen dependency on Russian natural gas resources. As close trading partners, economic cooperation has always been of great importance to both countries. As well as their existing close business, academic, and touristic ties between the countries, Turkey is one of the largest importers of petroleum products and the largest consumer of Iranian natural gas. Turkey, imports 94% of its oil resources, which meets around 31% of its energy consumption.

Iran also occupies a very important place not only in Turkey’s energy supply chain, but in the bilateral goods and services trade. Each year, Turkey welcomes from Iran around 17% of its natural gas needs. In this sense, Iran, Turkey’s largest gas supplier after Russia, has a relationship based heavily on resources.

Since 2000, trade turnover between Turkey and Iran has increased by 2500%, from $1 billion annually in 2000, to $22 billion annually by 2012, over the course of the last US and EU sanction against Iran. Iran-Turkey trade volume decrease since 2013 to 2017 due to these countries position in the Syrian crisis and US sanctions against Iran. In 2013, the trade volume dropped sharply, reaching $14.5 billion. The decline continued in 2014, with trade accounting for only $ 13.7 billion. The two countries, in an effort to strengthen trade relations, signed a preferential trade agreement at the beginning of 2015, and cut tariffs on imports of hundreds of goods. The purpose of the agreement was to increase the trade volume of the two countries to $ 35 billion a year.

Turkey is an industrial country with increasing energy demands due to high economy growth; on the other hand, in many senses, Iran is an ideal oil/gas supplier, with huge amount of reserves. Over the course of the AKP’s tenure over the country, relations have been generally positive and, in recent months especially, have been accelerating thanks to a drive in planning to maximize economic relations independent of external political and economic factors.

After the nuclear agreement, Turkish energy companies sought and signed many deals with the Iranian government. Since Turkey’s energy firms benefit from reliable financial and technological capital, Ankara is excellently poised to benefit the Iranian energy market. Turkish energy company Unit International reached a deal worth $4.2 billion with Iran’s Energy Ministry to build seven natural gas power plants, in what it said was the biggest investment in Iran since the lifting of sanctions. But by July 2018, with one stage to go before finalizing the agreement, it can be seen that due to the US’ withdrawal from the nuclear deal, Turkey has withdrawn the from Iran energy sector and decreased oil import from Iran. In mid-July, a delegation of the US Treasury and State Department met Turkish authorities to discuss sanctions targeting Iran. After the visit, Turkey’s Tupras began to reduce Iranian crude purchases. Following the agreement on the lifting of the sanctions against Iran in 2016, Iran began to increase its crude oil exports to Turkey and last year accounted for nearly half the country’s oil. Yet with new sanctions, one can expect that Iraq, Russia, and Saudi Arabia will fill the place of Iran, as has occurred in the past.

Although Turkey has at times complained about the quality and price of Iranian gas, the question should be asked as to whether Iran would be a more of a reliable supplier with the US now withdrawn from the JCPOA. Turkey is the largest consumer of Iranian natural gas, with no integrated natural gas infrastructure and natural gas pipelines of its own. Imports from Iran in short and mid-term will be important for Turkey. In winter, the southern part of Turkey needs more natural gas and natural gas, and demand in this area has increased dramatically,

Turkey has demanded Iran decrease gas prices in the past, appealing against Iran in International Arbitration Court in March 2012, and figures published officially in Iran in 2013 show that Iran decreased gas prices to around $416 in 2012, from $500 per 1000 cm in 2011.

By 2011, Turkey imported about 51% of its oil demand from Iran, and thus sanctions are not in Turkey’s favor, and thus will likely continue to purchase gas and oil from Iran, whilst finding new energy resources and suppliers. The US would thus be wise to offer Turkey with some alternatives or recognize the country as exempt from sanctioning the supplies it clearly requires.

Iranian technologies in oil and gas industries were relatively advanced before sanctions, with other countries able to compete only due to cheaper technologies and thus overheads. However, due to decades of sanctions, the country’s energy infrastructure is vastly out-of-date. Furthermore, despite recent reforms, Iranian oil and gas is almost totally nationalized, and foreign companies face problems in dealing with Iranian national oil and gas industries when it comes to negotiating terms.

Leave a Reply